Lock in your highest daily value for future income

Nationwide High Point 365®️ Select Lifetime Income rider

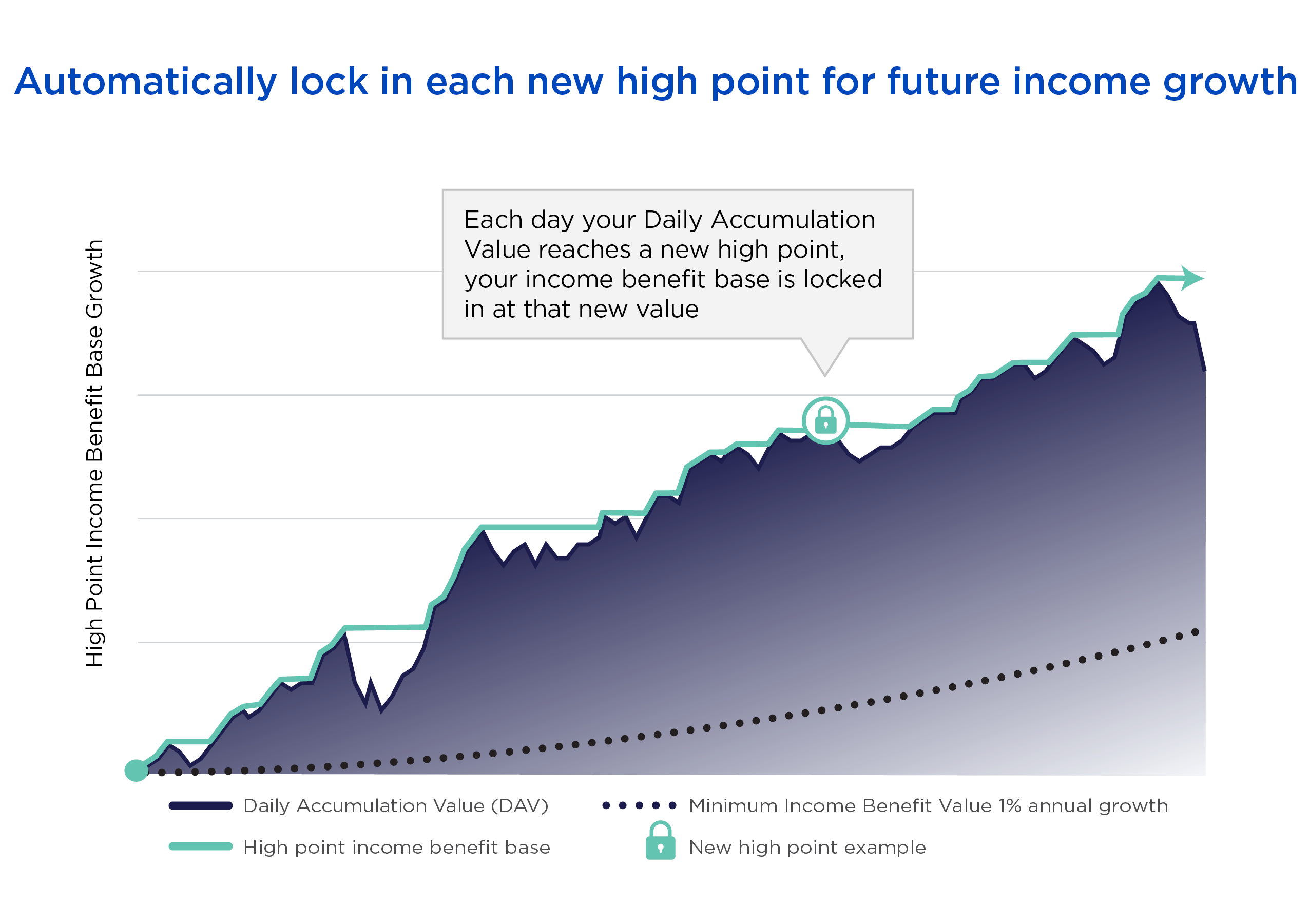

Nationwide High Point 365® Select Lifetime Income rider may be an option if you do not plan to start income for five years or more. It automatically locks in the high point income benefit base at every new high point your Daily Accumulation Value reaches, helping to potentially increase future income. Similar to High Point 365 Select with Bonus, your High Point Income Benefit base is the greater of the Highest DAV or Minimum Income Benefit Value.

Hypothetical Assumptions: This hypothetical example is not based on any particular New Heights Select product or index. It is intended for educational purposes only and is not a projection or prediction of future performance; your experience will differ. It assumes no withdrawals and that lifetime income has not begun.

Daily Opportunities for Income Growth

Similar to High Point 365 Select with Bonus, your High Point Income Benefit base is the greater of the Highest DAV or Minimum Income Benefit Value.

With the Nationwide High Point 365® Select Lifetime Income rider, the Minimum Income Benefit Value offers guaranteed growth of 1% per year for the earlier of 10 years or until you begin lifetime withdrawals. Once you begin withdrawals, your income will be calculated using the High Point Income Benefit Base and a guaranteed lifetime payout percentage.¹

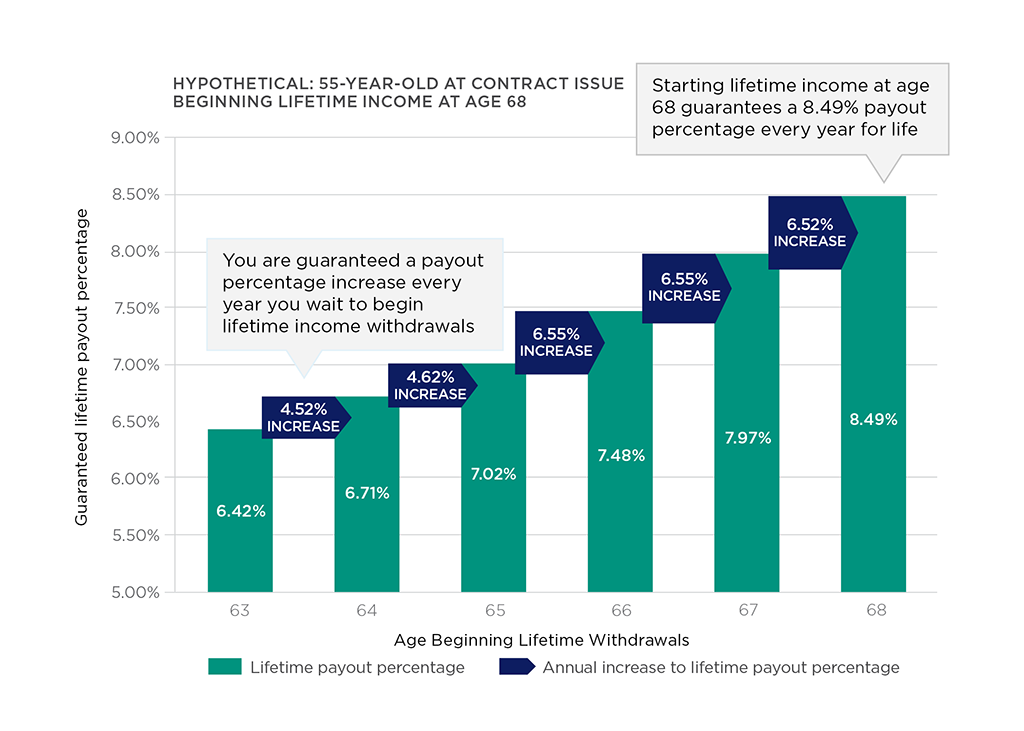

Guaranteed increases each year you wait

Your lifetime income will be calculated based on the lifetime payout percentage in the year you begin taking lifetime income withdrawals. High Point 365® Select features some of the highest payout percentages in the industry. This graph shows how each year you wait to begin taking lifetime income withdrawals, your payout percentage is guaranteed to increase, so long as you follow the terms of the contract and rider.²

Lifetime payout percentages vary by New Heights Select product, age at contract issue, completed contract years, which version of the rider was selected and whether the single life or joint life option was elected. Your experience may be different. Excess withdrawals will reduce your future income. If an excess withdrawal reduces the contract value to zero the contract and rider will terminate.

¹ Only one optional rider may be elected at the time of application for an additional charge. Please refer to the Product Profile and Lifetime Income Guide for details about features, limitations and additional rider charges. Availability may vary by state.

² Once your contract is issued, the range of payout percentages applicable to your contract will not change. After the fifth contract anniversary and date the younger covered life reaches age 50, the payout percentage is guaranteed to increase within that range every year income is deferred until the maximum age or payout percentage is reached or lifetime income begins. Please note that the range of payout percentages and maximum ages vary by New Heights Select product, age at contract issue, completed contract years, which version of the rider was selected and whether the single life or joint life option was elected. Once your lifetime income begins, the payout percentage is guaranteed not to change. All guarantees are backed by the claims-paying ability of Nationwide Life and Annuity Insurance Company. To see specific lifetime payout percentages for your age and retirement time frame, ask your financial professional for current rates or to run an illustration.

Annuities have limitations. They are long-term vehicles designed for retirement purposes. They are not intended to replace emergency funds, to be used as income for day-to-day expenses or to fund short-term savings goals. Please read the contract, product brochure, and Disclosure Summary for complete details.

Nationwide New Heights Select, an individual, single purchase payment, deferred fixed index annuity is issued by Nationwide Life and Annuity Insurance Company, Columbus, Ohio. Please note, the contract does not directly participate in any stock or equity investments. Withdrawals are subject to income tax, and withdrawals before age 59½ may be subject to a 10% early withdrawal federal tax penalty. Nationwide Life and Annuity Insurance Company, Columbus, Ohio 43215.

Nationwide, the Nationwide N and Eagle, Nationwide is on your side, Nationwide New Heights and New Heights are service marks of Nationwide Mutual Insurance Company. © 2024 Nationwide

ICC20-FACC-0126AOPP, ICC20-FARR-0122AO, ICC20-FARR-0123AO, ICC20-FARR-0124AO, ICC20-FARR-0125AO