Lifetime income

Nationwide High Point 365® Lifetime Income Benefit rider provides a guaranteed source of income you cannot outlive

Nationwide High Point 365 Lifetime Income Benefit rider (High Point 365) is an optional rider available for an additional cost with a Nationwide New Heights Fixed Indexed Annuity.1 High Point 365 may only be added at contract issue.

High Point 365 gives you two ways to grow your future income:

- Each year you wait to begin taking lifetime income payments2

- Each day your contract achieves a new daily high point

Helpful Resources

Guaranteed increases to your lifetime income each year you wait

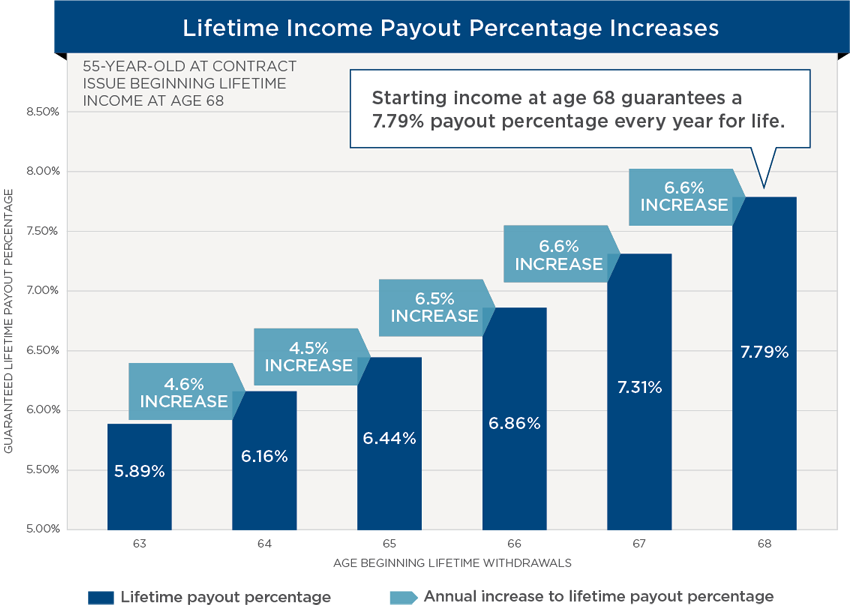

The first way lifetime income can increase is through the guaranteed lifetime payout percentage. Your lifetime income will be calculated based on the payout percentage in the year you begin taking withdrawals. Each year you wait to begin withdrawals, your payout percentage is guaranteed to increase.3

This graph shows an example of how the payout percentage increases each year until withdrawals begin.4 During this six-year period before starting lifetime income, the payout percentage increased over 32%. By choosing to begin lifetime withdrawals at age 68, the payout percentage would be guaranteed for life at 7.79%.

The lifetime payout percentages above are hypothetical and may not be available in your state. Lifetime payout percentages may vary by New Heights product. Lifetime payout percentages are presented as an example and may not reflect current payout percentages. Lifetime payout percentages are guaranteed at contract issue for the life of the contract and are subject to change prior to contract issue. Ask your financial professional for current lifetime payout percentages for your specific situation.

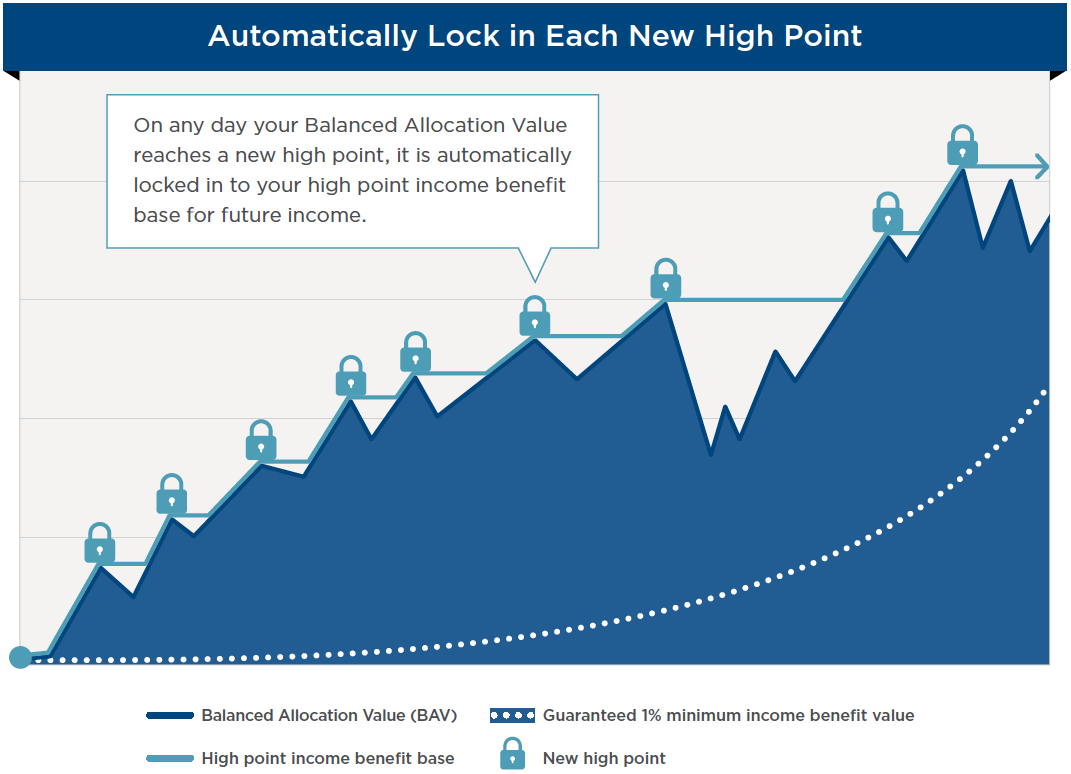

The graph above provides a hypothetical example of how High Point 365 locks in every new daily high point of the BAV to increase lifetime income.

Automatically capture each new high point to increase future income

The second way your lifetime income can increase is through your high point income benefit base. Your high point income benefit base is the greater of:

- Highest Balanced Allocation Value

On any day your Balanced Allocation Value (BAV) reaches a new high point, it automatically increases your income benefit base, even if you’ve already started taking withdrawals.5 - Guaranteed 1% annual roll-up

Even if the BAV does not reach a new high point, the minimum income benefit value provides a guaranteed 1% roll-up, compounded annually based on the initial purchase payment.6

1 The rider charge is an annual fee, assessed quarterly and reduces the contract value.

2 Lifetime income payments cannot begin until after the fifth contract anniversary and the date that the youngest covered life reaches age 50.

3 After the fifth contract anniversary and date the youngest covered life reaches age 50, the payout percentage is guaranteed to increase every year up to age 90 or achieving the maximum payout percentage. Payout percentages are based on age at contract issue and guaranteed for the life of the contract. All guarantees are subject to the claims-paying ability of Nationwide Life Insurance and Annuity Company.

4 All values presented are based on Nationwide New Heights 12 fixed indexed annuity with High Point 365. New Heights 12 may not be available in all states. Consult with your financial professional.

5 The BAV is the greater of the contract value plus any strategy earnings that have not been credited to the contract or the Return of Purchase Payment Guarantee amount.

6 The 1% roll-up rate is compounded annually from the date of issue until the earlier of the 10th contract anniversary or the date lifetime income payments begin.